IRR is one of the most critical metrics for real estate investors. But what is IRR, and how can you use it to evaluate potential investments? This blog post will provide a basic introduction to IRR and explain how you can use it to make sound investment decisions. Keep reading to learn more!

What is IRR? (Internal Rate of Return)

Internal rate of return (IRR) is a metric used in real estate investing in measuring a given investment’s profitability. According to Accounting Simplified, IRR represents the intrinsic rate of return that is expected to be derived from an investment considering the amount and timing of the associated cash flows.

To calculate IRR, the investor considers the initial cost of the investment, expected cash flows from the property and the expected sale price of the property. The resulting number is expressed as a percentage and represents the annual return on investment for the project. For example, if an investor earns a 10% return on their real estate investment and sell at the same price he bought, their IRR would be 10%.

IRR is an essential metric for real estate investors because it allows them to compare different investment opportunities and make informed decisions about where to invest their money. However, it is important to remember that IRR is only one factor when making an investment decision. Other factors, such as risks, liquidity, and market conditions, should also be considered.

Interested in continuing to grow your real estate knowledge? Check out our blog!

IRR vs. Net Present Value

In real estate investing, the Internal Rate of Return (IRR) and Net Present Value (NPV) are critical concepts often used to compare investment opportunities. Both measures take into account the time value of money, but there are some important differences between them.

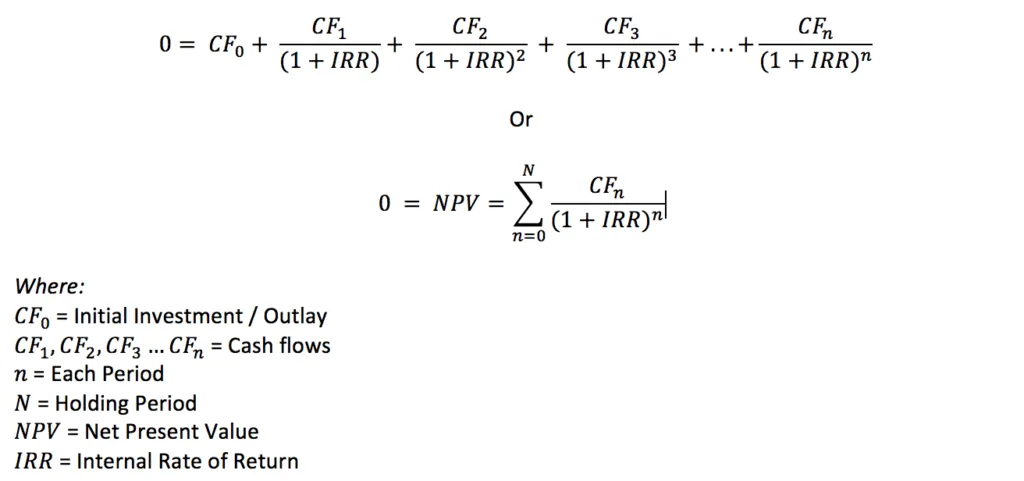

The IRR is a measure of the annualized rate of return for an investment. It is defined as the discount rate that makes the NPV of all cash flows from an investment equal to zero. In other words, it is the rate of return that would make an investor indifferent between investing in a project and leaving their money in a bank.

The NPV, on the other hand, is simply the present value of all future cash flows from an investment, discounted at a specified rate. It is a measure of how much an investment is worth today.

There are several reasons why investors might prefer one measure over the other. The IRR considers the timing of cash flows, whereas the NPV does not. This can be important when evaluating investments with different payback periods. Additionally, the IRR assumes that cash flows can be reinvested at the same rate, which may not always be realistic. For these reasons, the NPV is generally considered a more accurate measure of an investment’s worth.

Related Link: Real Estate Investment Basics – Cap Rates

ROI vs. IRR: What’s the difference?

ROI, or return on investment, is a simple calculation that measures the percentage of profit made on an investment. IRR, or internal rate of return, is a more complex metric that considers the timing of cash flows when calculating profitability. While both ROI and IRR can be useful for evaluating real estate investments, they each have strengths and weaknesses.

ROI is a straightforward measurement of profitability, which makes it easy to compare different investments. However, ROI does not consider the time value of money, meaning that it does not account for the fact that money earned today is worth more than money earned in the future. For this reason, ROI is best used when comparing investments that will be held for the same period.

IRR takes into account the time value of money, making it a more accurate measure of profitability than ROI. However, IRR can be more complex to calculate, and it cannot be easy to compare investments with different holding periods. For this reason, IRR is best used when comparing investments that will be held for different periods.

How Real Estate Investors Use IRR?

Real estate investors use the internal rate of return (IRR) to compare different investments and choose the one that will generate the highest return. IRR is a project’s annualized return, including the ongoing distributions and the sale proceeds. To calculate the IRR, investors first need to estimate the expected cash flows from the investment. Investors get interim rent payments and a lump amount when a property is sold over a few years. Next, they use a financial calculator or Excel spreadsheet to solve for the rate that equates those cash flows to the initial investment.

Once the IRR is known, real estate investors can compare it to other investment opportunities to see which one is more attractive. For example, let’s say that two properties are both expected to generate a 10% return. However, Property A has an IRR of 10%, and Property B has an IRR of 20%. This means that all things being equal, Property B is expected to give the same return in a shorter period. Of course, real estate investing is never exactly equal, but the IRR can still be useful for comparing different properties and making investment decisions.

How to Calculate IRR for Commercial Real Estate Investments

The Internal Rate of Return (IRR) is a popular metric for evaluating commercial real estate investments. The IRR is a measure of the expected yields from an investment, expressed as a percentage. It is important to note that the IRR is a forward-looking metric; it does not reflect the actual returns achieved to date. Instead, it estimates the returns that could be achieved if the investment performs as expected.

To calculate the IRR, one must first determine the investment’s net present value (NPV). The NPV is the sum of all future cash flows from the investment, discounted at an appropriate rate. The IRR is the discount rate that makes the NPV of the investment equal to zero. In other words, it is the rate at which the investor would be indifferent between investing in the project and leaving their money in a risk-free investment such as a government bond. The higher the IRR, the more attractive the investment. Understanding how to calculate this metric when considering real estate investments is crucial.

Calculating an IRR before investing requires certain data and assumptions:

- The investment amount

- Investors’ yearly payouts.

- The sale date and price.

Example: IRR of a 5 Year Investment With No Yearly Distributions and No Property Appreciation

Suppose you Invest $1,000, assuming you have five years without any financial cash flows. Assuming that $1,000 is distributed in year 5, the real estate IRR would be zero.

No financial flows were received, and the original investment was recouped after five years; therefore, there were no extra gains.

Example 2: IRR of a 5-Year Investment with Yearly Distributions

Let’s say you Invest $1,000 and assume that the project generates $100 annually. With the assumption that $1,000 are distributed in year 5, the IRR is 10%. This investment made 10% annually.

Example 3: IRR of a 5-Year Investment with No Yearly Distributions

In this example, you invested $1,000, assuming five years without any financial flows but considering a $1,610 final distribution. Despite no cash flows, the real estate IRR is still 10% since the investment value rose from $1,000 to $1,610 (10% compounded yearly).

Calculating this using pen and paper might be challenging for cash flows with many variables. Therefore, most individuals utilize internet calculators or spreadsheets. It’s important to note that these examples oversimplify the calculation process. Actual project cash flows vary.

Related Link: Top Ways Experienced Real Estate Investors Can Grow Their Net Worth

Why Do Real Estate Investors Need IRR?

Real estate investing is a capital-intensive endeavor. To finance their investment projects, real estate investors often turn to debt financing, which can come with high-interest rates and strict repayment terms. As a result, real estate investors need to generate a high return on investment (ROI) to make their investment worthwhile. By calculating the IRR of an investment project, real estate investors can get a better sense of whether or not an investment is likely to be profitable. Overall, real estate investors need to be aware of IRR to make informed investment decisions. Real estate investors can better assess whether a particular project is worth pursuing by understanding how to calculate IRR and what level of return is required for a particular investment.

A shorter-term investment with a more significant return may appear superior, but a longer-term real estate investment may have a bigger cumulative payoff.

“When evaluating different investment opportunities, the internal rate of return (IRR) is crucial; Nonetheless, it is important to constantly know what assumptions were used in the calculation.” – Guy Rippel, Business Development at SecondRE.

The Pitfall of Using IRR in Real Estate Investments

When it comes to real estate investing, there are a lot of different things that you need to take into consideration. One of the most critical factors is your return on investment (ROI). This is what will ultimately determine whether or not your investment is successful. Many people focus on the internal rate of return (IRR) when making real estate investment decisions. However, this can be a big mistake.

There are a couple of problems with using IRR as your primary metric. First of all, it doesn’t take into account the time value of money. This means it doesn’t consider how much money you could have made if you had invested it elsewhere. Another issue with IRR is that it is based on assumptions about future cash flows. These cash flows can be challenging to predict, particularly regarding real estate. As a result, there is always a degree of uncertainty when using IRR to make investment decisions.

For these reasons, real estate investors need to be cautious when using IRR as a metric. While it can be helpful in some situations, it can also lead to mistakes if not used correctly.

Alternative Metrics

Real estate investing is a complex and ever-evolving field, and there are a variety of indicators that investors can use to measure performance. IRR is just one tool in an investor’s toolkit and should be used alongside other metrics, such as Equity Multiple.

Equity Multiple measures the cash an investor receives from an investment relative to the amount initially invested. By looking at both IRR and Equity Multiple, investors can get a complete picture of how their real estate investments are performing.

Want to know how to grow your real estate portfolio? Contact us today!

Start Investing in Real Estate with IRR

The IRR is a measure of the profitability of an investment, and it takes into account the timing of cash flows as well as the overall riskiness of the investment. To calculate the IRR, you will need to know the expected cash flows from the investment and the current value of those cash flows. The IRR is then calculated by finding the interest rate that makes the present value of the expected cash flows equal to the initial investment.

There are a few things to keep in mind when using IRR to evaluate real estate investments. It is important to remember that IRR is a measure of profitability, not risk. An investment with a higher IRR may be riskier than an investment with a lower IRR. It is important to use realistic estimates of expected cash flow when calculating IRR. If you overestimate the expected cash flows, you will have an artificially high IRR. Remember that IRR is only one tool for evaluating real estate investments. It should be used with other measures, such as net present value and return on investment, to get a complete picture of an investment’s risks and rewards.

Related Link: Real Estate Investment Basics: Loan to Value